Sage 50 Cloud Support

Reach out Today! Give us a call – Get promotional pricing – send us an email to learn more!

Sage 50 Cloud Support – Master Advanced Features

Sage 50 cloud support – technical assistance for all versions of Sage50 cloud formerly Sage 50 and Sage Peachtree. Sage 50 cloud support is offered along sales, data conversion, implementation and training. At Accounting Business Solutions by JCS Our primary goal is to help your business and your staff become better at what they do resulting in more accurate information. Our Assistance helps small businesses manage and integrate the important parts of a business. Use Sage 50 it is a single system which connects each department when you work with Certified Sage 50 cloud support.

Sage 50 Sales – Sage 50 connects different departments of a business, and as an ERP application can eliminate costly duplicate and inefficient processes and free up resources for the business. Sage 50cloud integrates accounts payable, stock control, order-monitoring systems, and customer databases into one system.

Discover Sage 50 Data Conversion cost

Sage 50 cloud data conversion – Moving demographic lists, chart of accounts, customers, vendor and inventory items into Sage 50Cloud along with beginning balances. This enables a business to start off on the right foot when beginning to use Sage 50cloud.

Learn the price for Sage 50 implementation

Sage 50 Cloud Implementation – Helping small businesses set up Sage 50cloud to run efficiently for their small business. Sage 50Cloud Implement Onsite and Remotely – help you collect information about the activity and state of different divisions, making this information available to other parts, where it can be used correctly and productively.

Get Sage 50 Training

Sage 50 Cloud Training – Sage 50cloud training to help small businesses become more self-aware of how all the transactions link together, about vendors, customers, items, bill of materials and work tickets. Users can start to learn how to use the system based on best practices and from experienced real-world consultants and then gain skills in the advanced Sage 50cloud features.

What we recommend is to set up a demonstration for Sage 50cloud as it has many features that you would be able utilize. In addition, based on some of your additional inventory and business requirements taking a look at data conversion into Sage 100cloud as well. For Sage 50cloud Support Give us a call to set up your complimentary consultation. Give us a call 800-475-1047

Sage 50 cloud Support

Sample Discovery call / Request – DynaChem Manufacturing

This is a real life example of requests from a client prior to purchasing Sage 50. Not all of these requests could be managed by Sage 50. They also took a look at Sage 100 to learn the differences in features and price.

Summary of management requests for Sage 50cloud

Clients Main Concerns

Inventory control – needs to be real time as possible

Customer service needs to know:

- availability of product for sale

- faster approval turnaround for promise dates

- historical product sales by customer information

Production needs to know:

- availability of raw materials

- required quantities of finished product over time for production planning

- historical forecast of production needs

- availability of rework/returned products

Purchasing needs to know:

- stock status of raw materials

- production requirements of raw materials over time

- ordering requirements over time

- historical forecast of raw materials required

Accounting/Finance needs to know:

- up to date inventory costing and profitability

Operations needs to know:

- Raw material usage by category

- shipping and receiving schedules

Warehousing needs to know:

- inventory quantities On-Hand vs Allocated

- daily shipping requirements

- daily receiving requirements

Reduce duplicate or delayed data entry

Customer Service:

- Hand written approval requests

- Shipping Confirmations

- Bills of Lading

- Customer specific forms.

Production / Inventory Control:

- approvals prior to order confirmation

- updating multiple inventory spreadsheets

Warehousing:

- reduce the need for time sensitive physical checks for sales approval

- daily shipping and receiving quantities

Better Reporting or Reduce data manipulation time required to generate

Production/Inventory Control/Purchasing:

- Forecasting of inventory needs and reorder requirements

Accounting/Finance:

- Daily Gross Margins Report

Operations:

- Weight of raw materials used/month

- # of production batches/month by product type

- Raw material usage report / Batch net yield

Warehousing:

- Daily shipping pick list

- Product shipping / Day over time to check SO allocations

- Production / Day over time for availability and raw materials allocations

Use Sage 50 cloud for some additional tasks/tracking needs

Customer Service:

- Handle return authorizations during credit memo creation

Production/Inventory Control:

- Track returned product for re-use or waste

- track repair parts

Purchasing:

- use Purchase Orders for maintenance / repair purchases

Operations:

- track equipment maintenance / repair costs

Warehousing:

- Receive and track returned product

- Receive and track maintenance / repair parts

Sage 50 cloud support – Current Operations Flow

Orders:

- customer service receives order

- request availability status from warehouse and approval to ship

- warehouse checks stock for allocated stickers and/or checks pending for shipment file.

- if available returns approval for sale/shipment

- if full qty not available, returns partial approval or not approved

- request production of required quantities

- production checks quantity required

- checks pending production batches for UN-allocated quantities

- checks resource schedule

- checks raw material requirements

- if available or can schedules batch and returns approval

- if not available or can’t schedule in time frame returns alternative availability date when approved customer service prints sales order and sends confirmation.

When confirmation received send SO to warehousing and production if needed.

- shipper and shipping schedule confirmed and confirmation is printed.

- shipping schedule placed on schedule board.

Production batch # is issued and production is scheduled

- raw material inventory levels are checked again & physically confirmed

- rework / return materials are checked

- PO’s are issued for raw material orders

- receiving is scheduled

Production takes place

- raw materials are pulled from warehouse

- raw materials are charged to the batch and recorded by weight

- rework / return products are added to batch

- total weight of finished product batch is recorded

- finished product is added to bulk tank or containers are filled

Inventory control updates inventory (Sage 50cloud, Excel & SQC)

- records production by recorded quantity and estimated cost

- alleviates raw materials inventory by charged weight recorded

- inventory levels are checked and low levels passed to purchasing

Customer service creates bills of lading and invoices based on shipping schedule

Warehousing pulls and ships inventory based on shipping schedule

Finance runs a Daily Gross Margins Report based on actual and projected from sales orders in the system

Operations audits raw material usage for obvious problems and creates EHS reports

In order to utilize Sage 50cloud these would be the Suggested changes to work flow procedures –

this process could be made more efficient using Sage 100cloud.

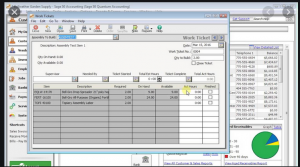

By setting up finished product as assemblies with standardized bills of materials and utilizing the work ticket entry screen to record pending batches and by entering completed batches as completed work tickets, more immediate approximations of current raw material levels than when using the current adjustments method. Inventory adjustments for rework/returns would need to be made at the same time as batch production is recorded. Amounts produces on the work ticket would need to correspond only to production based on raw materials.

To standardize input and tracking procedures, separate inventory items will be created for filled containers, incorporating the container and appropriate amount of bulk product. Filling the containers would be recorded on a separate work ticket. This procedure will provide better solutions in a number of areas. When entering the initial work ticket, immediate feedback will be provided on material levels based on work ticket date showing qty required, qty on hand and qty available. Qty available included Qty On-Hand less Qty on prior/entered dated Work Tickets, less Qty on prior dated/entered Sales Orders plus prior dated/entered Purchase Orders.

There are currently no convenient reports to get this inventory level feedback, so as new work tickets are entered subsequently date work tickets can be checked for changing component levels. As batches are finished and marked as completed, standard component quantities will be depleted resulting in good approximations of stocking levels without having to wait the 2-3 days it sometimes takes for reported quantities used to be entered. Reported quantities used will still need to be entered as adjustments to the standard quantity for more exact quantities. By appropriately flagging ID’s in work tickets and adjustments, filling, rework and returns can be stripped from batch production information for EHS required reporting. Completed work tickets will also update finished product inventories for better look-up quantities for customer service.

Customer Service, production and warehousing will be able to look up available quantities on the Inventory Item Maintenance window. This screen shows Qty on Hand, Qty on SO’s Qty on PO’s and Qty Available which includes the proceeding +/- Qty on WTs. This screen’s calculations are based on transactions dated prior to the end of the current accounting period. To get more accurate availability, reports would need to be generated. Better Quantities available could be obtained by printing out 2 or 3 week rolling daily inventory pending availability reports.

One for items pending on Sales Orders another for pending based on Work Tickets. Work Tickets and Sales Orders are stored in separated data tables, so combining them into a single report may be very difficult and/or generating the combined report may take a very long time. Checking a quantity on hand and 2 running total figures will still be faster than the current practice of waiting for approval. Similar rolling quantity balance reports for PO’s and Sales Orders can be run for production raw material need. Again, Purchase Orders and Work Tickets are stored in different tables. These reports could also be used as an audit of production to shipping requirements.

Toll manufacturing can be billed at any time so long as you keep inventory considerations in mind. To not affect inventory at the time of billing simply do not use an item ID in the ID field but fill in all description lined as you normally would. When the product ships create another invoice with the item ID but at zero price to relieve inventory and record cogs. You can associate the 2 invoices if needed by using same invoice number with a suffix designating shipping (like -S)

Sage 50cloud inventory is highly date sensitive, so all transactions dealing with inventory need to be dated on the date you want inventory affected. To use the qty on PO’s, SO’s and Qty available base on these figures and Work Tickets (WT’s) lookup amounts effectively, these documents will need to be dated based on expected shipping dates, expected receiving dates or expected production dates which should be updated as they change. Alternatively, we can pull reports based on ship by in SO, Good Through in PO and Needed by in WT’s,

Sage 50 cloud support – Implementation Steps

Inventory meeting – this meeting should establish standardization’s for your Finished products and to define your bill of material (BOM) lists. This is a good time to adjust you Item ID structure for better report ordering or ranging. You will need some fields to help pull information for reporting; for instance, inventory running quantities available over time reports may have different items listed for customer service, production or warehousing; there needs to be a spot for recording EHS classifications, raw materials should be distinguished from finished products, raw materials that are also sold and service/maintenance products if you decide to track them in a single company.

A spot for the hazardous materials code should be chosen. It might be useful to set up Units of Measure and standard conversions. This would allow for physical inventory to be done by container count. This is probably not a good option for you since there is no way to handle partial containers in Sage 50cloud, but it may be useful in some instances. Decide on future need for labor or overhead added to assemble item cost at production. Remember that you will be setting up bill or materials (BOMs) based on a single pound produced, so make sure that any labor/overhead added to the BOM would make sense being multiplied by the total batch weight. There is not a way to add a standard, per batch cost.

Suggestion – it is my suggestion that you use the Item Type Field for broad category distinction or to distinguish between separate GL inventory accounts. For instance, raw materials – RM, Finished Goods – FG, Raw materials that are also sold – RS, Finished Products that are used in other assemblies – FC, Rework – FR, Repair/Maintenance Parts – PM. Thus, RM and RS could be combined in a single Sage 50cloud report for all raw materials or printed separately.

The hazardous materials code should be entered as a custom field. The EHS category should be entered as a custom field. Standard batch sizes should be entered as a custom field. Key raw materials should be recorded in a custom field and possibly as part of the Item Type field. To combine multiple raw material ID’s on reports under as single chemical name, that name should be placed in a custom field. Structuring account ID’s is important for report selection and sorting needs. Crystal has some text parsing capabilities (not as extensive as Excel) but to get the most flexibility ID’s should have a consistent structure that can be alpha-numerically ranged for desired reporting groups.

For example, to get a report on all stocked quantities of a specific product no matter what container that product is stored in, the product should be listed first followed by the container type possibly followed by a code for rework, returns, or untested of either. By using a consistent number of characters and appropriate alpha characters, we will have the most flexibility in Sage 50cloud reporting and the easiest time creating reports in Crystal.

If you decide that labor/overhead are appropriate and may be needed in the future, add them now. Set up appropriate labor/service/overhead items based on either individual finished product, production method or common labor task and attach them to the BOM. Actual Item Unit cost should be set to zero until you’re ready to use them. The inventory account should be set to a contra-wage account. This account will be credited at the time of assembly. Maximum capacity can be set in a custom field for look up or possible incorporation in a crystal reorder worksheet.

Test inventory decisions. – setup a test company, enter raw material components needed and all BOM’s for a couple of finished products including the bulk product and one for each fill method. Backup and test report pull and ordering in Sage 50cloud. Test some work order batches so you’ll get a feel for how this is handled and for how and when information is available. If you decided to implement units of measures, test how UOM conversions work and appear on Sage 50cloud reports. Revise you ID structures, UOM’s or BOM lists and retest as needed.

Suggestions – a test company can be set up in one of 2 ways. 1 – Copy your current company data into a new folder and rename. This will provide you with list information and data to test. To use current Item ID’s for the new BOM items, rename the current stock items to something else (maybe zStk-<current ID>). 2 – Setup a new company and export/import list information from your current working company. I recommend the 2’nd option. Tests will be faster and you’ll gain experience importing and exporting. Copy employee and sales tax files from working co folder to new company before attempting import.

It’s easier to import employees without any associated tax calculations and accept the defaults. Import lists in the following order (Employees, Vendors, Customers, Items) Though many of you have expressed a desire to continue in your current data, this is not optimal for a number of reasons. To change over to Work Ticket oriented inventory tracking you will be increasing the number of inventory items until they can be purged in closed years. Over time, any database can develop problems or corruptions and I saw some signs that this problem may exist in your data. I’ll provide options for both, but it’s your choice which to pursue.

Enter all new BOM’s and update raw materials inventory for Item Types, Custom Fields and UOM’s if you have decided to use them. Print and audit changes.

Suggestions – Doing this in a test company, prevents inadvertent changes to your current inventory structure, may speed entry, prevents update work from using resources in working company that can slow down actual work. When you convert over to using the new structure, if you have decided to continue working in your current data set you will need to rename any ID’s to be replaced and then either import the new BOM items or rename them from whatever your temporary names are. This second renaming could take considerable time.

Meeting to discuss standardization of batch numbers as references in Sage 50cloud

Suggestions – You are currently using your batch number as a reference for inventory adjustments to be able to pull data. This results in duplicate transaction ID’s which can sometimes result in data corruption during purges. At a minimum you will need to set up a consistent structure to account for the initial bulk production (<actual batch number>) any associated fill batches (<actual batch number>F or <actual batch number>-F) associated rework/return incorporation in adjustments (<actual batch number>R or -R) and adjustments to actual from standard (<actual batch number>A## or -A-##) where ## is unique for each component adjusted (01 for first, 02 for 2nd ..etc.). To transfer a product with an alternate Item ID to accommodate different formulations (<actual batch number>-T).

During Inventory Item Update begin planning and writing the Crystal Daily 2- or 3-week rolling inventory requirements and availability reports. This report should be ready at cut over.

Suggestions – at a minimum, you’ll need 4 reports, 2 for availability and 2 for requirements. Open PO provide daily incoming raw materials and open Work Tickets daily finished product availability. Open Sales Orders provide daily Finished product needs and Open WT’s information about raw materials needs. The last will be a difficult report to create. Because of data structures, WT information would be very difficult to combine with SO or PO information. It could be done by using shared variables and passing the results from a sub-report, but this would likely take a VERY long time to generate. The other option would be to export the 2 reports to be combined and then either manually combine them or use crystal to combine then. If Ed needs help with these, let me know.

During Inventory Item Update begin planning and writing the Crystal Daily Gross Margins Report. This report should be ready shortly after cut-over but if written correctly, it could work in the current data set. Talk to Jerry about priority.

Suggestions – I did not get a copy of this report and do not remember exact column headings. It would combine information from both the sales journal and the sales order journal to provide actual and projected gross profits. Cost for item projections based on Open Sales Orders will need to be calculated using last cost. There is no real way to associate Freight costs with a particular sale. Two possible solutions exist. 1 – set up freight ID’s as Stock Items w/ average cost and attach that Item to the sales invoice.

It does not need to charge an amount to the customer for a cost to be recorded. This would not associate and exact cost, but over time costs would average out. Multiple freight types and or levels could be created with similar price ranges to get better approximations per invoice. Negative inventories for this item would need to be closely watched. 2 – Purchase orders and Purchase invoices allow you to associate a given invoice to a customer and sales order number by using the drop ship flag. There is no real association in Sage 50cloud, but a purchase could be associated with a given SO or Invoice # in Crystal to relate them.

Meet to discuss and decide on a cut-over date

Suggestions – after entering enough of the inventory change to determine a time frame for completion, start looking at a good time for cut over. At cut-over, you will need to have a verifiable inventory count and be able to audit other current balances. Cut-over itself will take time (see cut-over instructions) and if possible, testing of/training in/ or practice of new procedure is always beneficial. This can all be done by using a copy of your inventory setup company.

Cut-over assistance from Sage 50 Consultant

Make sure ALL transactions are recorded.

Do a Physical Inventory

If you need to create sales orders or purchase orders during this time frame, do so in a second, temporary company to be reentered after cut-over.

Entering cash receipts or disbursements for existing invoices should be fine but track them for auditing.

Make sure to account for ANY unrecorded shipments, receipts, production or usage during this time. It would be better to shut down, but if not possible record any transactions in the temporary company to be reentered in working company after cut-over.

Set security to at least read rights for inventory maintenance and inventory related transactions for everyone who needs information on inventory levels so they can track down details if needed.

Option 1 – cut-over within current data set.

Backup

Print reports. GL trial bal. Income Statement, Balance Sheet, Inventory Valuation, Open PO’s, Open SO’s

Adjust all inventory to Zero.

Audit in item costing report for remaining quantities.

Backup to new backup file

Rename all old ID’s that will no longer be used and mark as inactive

Backup to new backup file

Audit name changes print report showing active items only.

Import or rename new BOM items.

Audit

Backup to new backup file

Enter inventory beginning balances

Audit Inventory value.

Audit GL against prior reports and make adjustments to inventory or costing as needed

Backup to new backup file

Correct items as needed on Open PO’s & SO’s (they will be looking at old/changed ID’s

Audit PO’s & SO’s

Test daily requirements / availability reports

Backup to new backup file

At this point you can begin actual data entry, though cut-over is not complete.

Correct Memorized transactions.

Re-enter any transaction data entered in the temporary company.

Enter work tickets for scheduled production batches.

Test work ticket related reports.

Option 2 – cut-over to new company.

Backup

Print Current Period Reports. GL trial bal. Income Statement, Balance Sheet, Inventory Valuation, Aged AP and AR in detail, YTD payroll, Open PO’s, Open SO’s, Account reconciliations.

Print prior YE reports to establish beginning balances GL trial balance, Inventory Valuation, Aged AP and AR in detail

Use your test company with corrected inventory and NO transactions.

Backup new company

Export/Import lists other than inventory in order (GL Budgets, Employees, Vendors, Customers, cost codes, phases, jobs)

Backup new company to new backup file

In old company rename all Item ID’s to correspond to new ones.

Enter YE beginning balances (GL, AR, AP & Inv.) PR not applicable at YE

These can be entered manually or exported reports can be exported and manipulated to import as transactions.

Audit YE Beginning balances.

Backup new company to new backup file

Export transactions starting the first of the year. SO’s and PO’s should go back a month or 2 to account for what was open at the beginning of the year.

Import transactions in the following order. GLJ, POJ, PJ, InvAssmJ, InvAdjJ, SOJ, SJ CDJ (payments), CRJ, PRJ. Backup between each journal

Audit current balances against reports printed from current company

Adjust all inventory to Zero.

Audit in costing report.

Backup to new backup file

Enter inventory beginning balances

Audit Inventory value.

Audit GL against prior reports and make adjustments to inventory or costing as needed

Backup to new backup file

Test daily requirements / availability reports

At this point you can begin actual data entry, though cut-over is not complete.

Correct Memorized transactions.

Re-enter any transaction data entered in the temporary company.

Enter work tickets for scheduled production batches.

Test work ticket related reports.

Memorized transactions cannot be easily moved, but I do have a procedure that may help on ones with many items.

In your current data set, before renaming and inactivating your Old Item ID’s, backup the company and rename them instead to the new ID’s.

Create a bogus transaction for each lengthy memorized transaction and save it with an easily ranged ID set.

Export these transactions.

When you’re ready to correct the memorized transactions, you can backup and import these normal transactions and call them up one at a time and save it as memorized. Then delete the bogus transaction.

If using option 2 you can copy the 2 files associated with memorize transactions (stxhdr.dat and stxrow.dat) from your old company to the new company. The ID and description for the memorized transaction and any description lines will come over intact, but any Item ID’s and the associated customer will probably be wrong since they look at a record # and not ID’s. If you do this they will have to be corrected before any of them are used for data entry to avoid possible corruption issues stemming from invalid record numbers.

Sage 50 cloud support

Other Implementation Issues – these are items that are not really time related to the actual Cut-Over.

Plan and create custom Crystal report for Pounds of raw of key raw materials used per month. It should be fairly easy to pull this information from the costing file based on assemblies and adjustments for items marked as key materials in inventory. Formatting as a chart with key material chemical name rows and months will be the challenge, but there is an example report that may prove useful.

Plan and create custom Crystal report for production batches by EHS classification. This should be based on information in the assemblies’ journal, stripping out any Fill Batches by the batch number suffix. It can be compared to the standard batch amount stored in the custom field for that item and manipulated with whatever formula Craig supplies to come up with total # of batches.

Plan and create custom Crystal report for material usage auditing. Because of data entry constraints it will be difficult to create this report in the format Craig has requested. I have not used the cross-tab function in Crystal on derived total fields before, and getting this to work would be the best solution. In any event Crystal should easily be able to pull this information from adjustments and assemblies to be exported to excel to manually set up the tables or to be used as an import source for a tabular crystal report.

Freight tracking was discussed above but I’m not sure I understand everything you want tracked this needs additional discussion.

Authorized Returns can be tracked through either PO’s or negative SO’s. PO’s are the better choice. A separate PO form for the Return Authorization can be created and printed. It can be received as any other item.

Bills of Lading and other Forms. Any text form can be created in Sage 50cloud and printed. This is never an automatic process however and page breaks cannot be defined to allow a second page of text to print as an attachment to another form. Forms like your shipping commitment form and bill of lading duplicates some information in Sage 50cloud transactions. The forms can be designed with blank space for the additional information to be written in, but there will be no tracking of that info. To print a bill of lading directly from Sage 50cloud would require that the data be entered with the descriptions and order required.

So SO’s in Invoices would also print this way. A Crystal bill of lading or other form can be created which could re order the lines or add hazardous material warning based on custom field on the Item and a table of substitutions or order in crystal. This would still not be able to fill in dynamic information like case count, though in some cases it could be calculated. There is also a crystal report we can help you with if you wish a bill of lading using your Sage 50cloud information. Multiple customer specific forms like packing slips can be created so long as Sage 50cloud has the information.

The shipping programs available as attachments to Sage 50Cloud are generally links to or dedicated to FEDEX or UPS programs. I could find none that allowed for tracking a table of preferred carriers per location, quotes or even rates for other carriers.

Need to locate a logistics program that could link to Sage 50lcoud.

The add-on for Bar-Coding of inventory to help with shipping, receiving or physical inventory is now called the EZScanIt Suite. I can be implemented at any time. I see no help in this solution for better on time inventory levels but it can help with shipping/receiving/count data entry. We can schedule a demonstration of this add on for Sage 50cloud when you are ready.

Maintenance and Repair tracking for equipment can be handled though job costing. Simply set up a job for each piece of equipment. Purchase invoices can be applied directly to an expense to a job if it’s not for a stock item. Stock items can be relieved from inventory and cost applied to a job. Employee time and cost can be applied to a job through PR entry, and misc. expenses can be applied through the debit side of a GL transaction. Jobs can be broken down into sub categories (phases) like repair and maintenance or further categories for more detailed reporting (labor, materials, subcontract, etc.). Your data base is large with its current inventory and transaction level and the number of transactions will increase with the work ticket solution. If you want to also track a large repair parts inventory or your transaction volume for these items in large you may consider tracking them in a separate company.

Plan and create custom Crystal reports for Sales history and/or material use charts to help in forecasting of inventory needs.

You can begin printing picking lists at any time as they are bases on Sales order information already in the system.

Begin printing initial quotes for pending order approval at any time to have a record of approval and all can see the details. Lost orders can be simply deleted.

Plan and create custom Crystal reports to show planed production, shipping and usage over time. Limited cycle counts can be done on anything not on that report so lone as all other transaction data has been completed.

Sage 50 cloud Support

Our Sage 50 cloud support staff can provide a demonstration for Sage 50cloud so you can discuss your business requirements. What we recommend is to set up a demonstration for Sage 50cloud as it has many features that you would be able to utilize. In addition, based on some of your additional inventory and business requirements, taking a look at a data conversion into Sage 100cloud as well. Give us a call to set up your complimentary consultation. For Sage 50cloud Support Give us a call 800-475-1047

For Sage 50 cloud support give us a call 800-475-1047

Sage 50 Cloud Support Quantum

Sage 50Cloud Premium

Sage 50Cloud Pro

Sage 50cloud Quantum

Sage 50cloud Premium

Sage 50cloud Pro

Sage Timeslips Support and Sage 50cloud training classes