What is Sage 100 Intelligence Reporting?

Sage Intelligence

Sage 100 Advanced Reporting

What is Sage 100 Intelligence Reporting and why use it? Sage Intelligence is an Excel-based reporting tool used by thousands for easy access into the Sage 100cloud data tables. It is simple to get started so you can take advantage of Sage 100 advanced reporting. Working with skills you already have, and based on the features you are familiar with from Excel you can create critical reports for your business. Gain insights into your entire company and use the data to help make decisions to drive improved operations.

Start creating Sage 100 Custom Reports with out of the box reports so you can immediately get to work. Once you become familiar with navigation you can put your existing knowledge to work slice, dice and organize your information in a relevant and logical manner. For Sage 100 advanced reporting or if you need technical assistance our services include:

- Personalized Training

- Custom Report Writing

- Sales for Sage Intelligence

- Sage 100cloud Technical Assistance

Based on the familiar Microsoft® Excel® application, the Business Intelligence module lets you effortlessly create reports and analyze data. Empower your business with Sage Intelligence providing Sage 100 Advanced Reporting.

Complex reporting made easy:

- Sage Intelligence has a familiar Microsoft Excel interface

- Easily customizable out of the box financial, sales, purchasing, and inventory report templates and dashboards

- Convert Sage 100 FRX reports

Transform your data into actionable information:

- Powerful multi-dimensional analysis

- Perform what if scenarios that go beyond just transnational data

Consolidate data from multiple Sage 100 companies and multiple sources

- Required Sage Connector Module

- Simplify multi-company reporting

- Add multiple sources of information

Access Strategically Meaningful Information.

Simply run one of the out of the box reports and start slicing and dicing information. If needed, customization and personalization of a template is a simple and straightforward process to create Sage 100 custom reports.

- Free up Resources and boost productivity with reusable templates

- Schedule and deliver frequently used reports

Business Intelligence reduces manual Sage 100cloud reporting preparation, repetitive data extracts, and complex back-end data joins to provide you with up-to-date, accurate, and presentation-quality reports for informed decision-making.

Module Level Security

Sage Software – Sage Intelligence reporting also offers Module-Level Security and Report-Level Security. If you need Sage 100 Custom Reports with more powerful reporting and dashboards other options include:

- Microsoft Sage Power BI

- Sage Crystal Reports

- Standard Sage 100 Reporting

- Sage Dashboard Insights

Accounting Business Solutions by JCS – for Sage 100 custom reports

Certified Sage Consultants Sage 100 Advanced Reports Technical Support and Training

Sage 100 Intelligence Reporting

Crystal Reports

Business Insights Dashboard

Give us a call 800-475-1047 or visit us for more information at www.jcscomputer.com

Top 15 Things You Need to Know About Sage 100 ERP Sage Intelligence Reporting

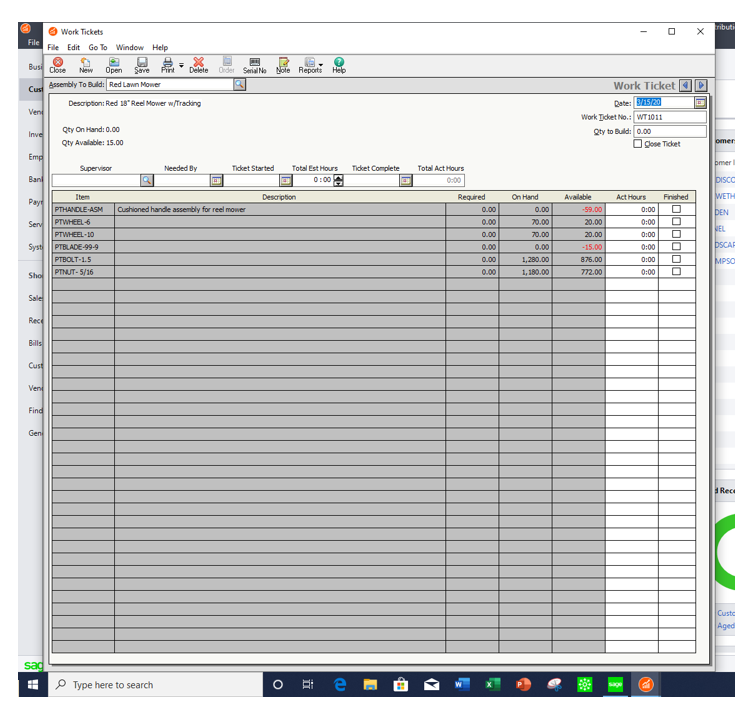

Sage 100 Custom Reports – Create Sage 100 advanced reports, visualizations & reporting dashboards. Merge data together without code. You can define the data that is include on the report and what the final output design looks like. Choices you will need to make is how the report is sorted and subtotaled. Often you can have one version that is a summary and another that is a detailed view. Do you want all the detailed information or do you need a selection prompt that allows you to slice and dice your data for only a few key records?

1. Seamlessly integrated into Sage 100cloud ERP.

Sage Intelligence Reporting is a tightly integrated business intelligence solution for Sage 100cloud. Providing low cost of ownership and rapid deployment for a cost friendly budget. Once installed Sage Intelligence is launched from within the Sage 100cloud system.

2. On Demand real-time information.

Sage 100 Intelligence Reporting empowers you to run reports at the click of a button, pulling trusted real-time information directly from the ERP database into Microsoft Excel®—in the format of your choice. Intelligence Reporting helps you save time and get more accurate reports by eliminating redundant data entry. Different levels of detail can be displayed within the reports, while the data can be drilled down into for transaction details as required.

The data has always been there; however, Intelligence Reporting puts it into an easily digestible format and gets the right information to the right people, when they need it, providing visibility of what has happened even in the last few minutes. A clear understanding of the transaction history in your database, and visibility of trends at a glance, empowers you and your team to make decisions based on timely, relevant, meaningful information, which gives you the means to plan ahead and grow in the face of competition.

3. Drill down to uncover the underlying transaction details

Sage Intelligence Reporting Dashboard and Financial reports ship with real-time pre-built drill downs to the source data. Users also have the ability to create and configure custom real-time drill downs to any data they choose. Once set up, easily access the data using the “right-click drill down” feature from within Excel. Each time you drill down, live data is extracted from the database, allowing you to quickly look at the underlying data to certain metrics and take corrective measures.

4. Completely Microsoft Excel-based

Report creation, organization, drill down, and housekeeping of reports are done from the Intelligence Reporting proprietary interface, which makes administration of reports easy to manage. However, reports are delivered in the familiar Excel interface and can be manipulated, analyzed, and distributed accordingly. Intelligence Reporting seamlessly draws trusted data directly from your company’s database(s) and delivers it automatically into the tool you are already compiling static reports in today, Microsoft Excel, making it easy to adopt.

You don’t have to be a programmer to get the data, and you don’t need to be an accountant to interpret the data. Information can be “sliced and diced” extensively using the powerful native functionality of Excel, such as PivotTables, for more insight. This leverages existing Excel skills in your business and lowers your total cost of ownership. Intelligence Reporting allows businesses to continue using Excel as their preferred data sharing application in a controlled, secure environment but eliminates “spreadsheet chaos.”

No more cutting and pasting repetitively, no more human error, no more doubt about data accuracy. With Intelligence Reporting decision-makers can spend less time gathering data and more time focusing on strategic analysis and interpretation with up-to-date, accurate, and presentation-quality reports. Intelligence Reporting supports Excel 2003, 2007, 2010 and 2013.

5. Includes various prepackaged reports to use as starters

An entire library of ready-to-run reports is delivered out of the box to get you up and running immediately and enable you to produce meaningful reports right away. There are many report templates out of the box. For financial statements included are several iterations of financial income and balance sheet statements, GL trend analysis dashboards.

For operations there are comprehensive KPI dashboards, customer sales, inventory status, vendor purchases, and operation analysis reports. Each have been carefully developed and researched to meet a wide range of reporting requirements. If necessary, these reports can be reformatted or built from scratch in Excel to meet your company’s needs and saved in the customized format for repeat use.

- Dashboard Analysis Template: this 1-page summary of key business information features “Top N” Reporting on expenses, items, and customers. Profit and Loss are also featured for the current month and year-to-date.

- General Ledger Transaction Details Template: shows the account transaction details, description, amount totals, dates, and reference. This report allows functionality using Microsoft Excel PivotTable® and additional elements to be involved.

- Customer Sales Template: this report features sales information for customers including costs, gross profits per item and/or per customer and item sales. PivotTable® allows for additional elements to be manipulated.

- Vendor Purchases Template: filter this report by items or vendors, it lists purchase information including cost and item numbers for any date range chosen. PivotTable® allows for additional elements to be manipulated.

- Inventory Status Template: this report shows the item and quantities along with location. PivotTable® allows for additional elements to be manipulated.

- Financial Reports: allows for the review of balances for your General Ledger for any financial period chosen. Layouts are generated, subtotaled and grouped by financial category. This report also allows customization using Excel.

- Financial Trend Analysis Template: gives you the information you need to see what comparative trending over a period of time. This powerful feature allows you to pinpoint analysis of trends to the appropriate source it is driven by.

- Financial Report and Consolidated Financial Report Template: these reports are available immediately and show you comparative balance sheets and income statements for your chosen defined time period. All reports offered in this template are fully customizable with Excel.

6. Scalable, powerful flexible financial reporting.

Intelligence Reporting is new-generation BI software, designed from the ground up with SMME needs in mind; for example, it specifically addresses serious challenges around financial reporting—which are prevalent worldwide—like departmental reporting, GL segmentation, and project reporting. The Report Designer fast tracks the building of powerful financial reports using an easy-to-use, drag-and-drop interface to allow for flexible financial reporting with multilevel groupings according to your unique business needs.

7. Optional Report Designer puts control at your fingertips

The Report Designer Add-in (available as a free download on the Sage Customer or Partner portal) provides an alternative method for building advanced financial reports and allows you to take even more control of the design aspects of your reporting layouts. The Add-in provides drag-and-drop Excel financial formulas, which communicate with an In-Memory processing engine for brilliant performance and greatly enhanced flexibility.

Creating multiyear and multi-budget financial reports is quick and easy using the simple drag-and-drop options. You can also easily control the way your accounts roll up using ranges and arithmetic, allowing you to present the required level of detail in your reports. With the Report Designer Add-in all financial reports are interactive from the In-Memory Engine, allowing users to interact dynamically with GL data in real time.

8. Convert previous Sage 100 FRx reports.

FRx reports can be efficiently converted to Intelligence Reporting using the Report Designer Add-in by simply exporting them into Excel and linking them. All existing Excel financial spreadsheets can be converted using this method. A comprehensive conversion guide is available to take you through a step-by-step conversion process.

9. Reach into every corner of Sage 100 data

Intelligence Reporting takes you beyond financials to provide insight into data from across your entire business, offering you total flexibility. You will be able to combine information from multiple sources, possibly from your ERP, CRM, and payroll databases, or from multiple companies, divisions, and departments into one report. The Connector module offers connectivity into all Sage ERP modules and systems without having to link spreadsheets, understand the underlying database structure, rely on Visual Basic knowledge, or create additional content packs for each additional module outside of the General Ledger.

Multi-company reports and consolidations can be created quickly to provide instant visibility into meaningful information from across a business for insightful decision making. You can custom-design almost any report you need, giving you total control over your reporting process. Every customization you make can be saved for future use, sparing you time and effort. Dashboard reports will give you a good idea of the health and well-being of the company by displaying current metrics and key performance indicators (KPIs) in a graphical format so that trends are visible at a glance.

The ability to effectively analyze your data with powerful dashboard tools will help you make better, faster, and smarter decisions.

10. Options for Users to choose from.

Intelligence Reporting is available at different user levels and for multiple databases. You can select licenses and modules individually to build a reporting system that best suits your current and future business requirements. Report Viewer Licenses allow users to run existing reports to get access to real-time information and have some basic filter and change parameter editing capabilities, including drill down.

Report Manager Licenses have the capabilities of Report Viewer, plus the ability to customize reports, set up parameters, establish new templates, and schedule and distribute reports. More powerful report building capabilities are available in the Report Designer module, which gives you total flexibility to create as many different customized financial layouts as you wish through an easy-to-use “drag and-drop” interface. For access to unlimited multiple disparate databases and consolidating data from multiple companies, the additional Connector Module is available.

11. Model your own reporting structure using Reporting Trees

Reporting Trees functionality in Intelligence Reporting allows you to model a reporting structure that best represents your organization and view it in many different ways with just a few clicks. Users can model their business units independently to their chart of accounts and quickly change reporting angles. Adding new departments or regions is easily managed, without having to make changes to your GL, and you can control which financial information is made available for departmental or regional reporting. The Reporting Trees capability built into the software can easily replace any FRx Reporting Tree

12. Schedule report distribution using automated scheduling.

This process is made up of 3 easy steps:

1. Decide where you’re going to save your report.

2. Create the Scheduler Command.

3. Set up the Windows Scheduler Task.

In order to effectively drive daily business decisions, Intelligence Reporting provides anytime access to business-critical information. Getting the information to the right people is key! The powerful Report Distribution feature allows for fully automated, unattended report distribution, which facilitates improved collaboration among teams, no matter where recipients are located.

Features include the ability to create rule-based alerts, insert previews of report data within the body of your rich text email, and select which worksheets you want to send to whom. You have the option to send reports in various formats, such as PDF, HTML, and Microsoft Excel. Distribution methods include email, FTP site, SharePoint, Skydrive, Dropbox, and shared network folders. The distribution rules are created once and can be reused across all reports.

13. License(s) is included

All current customers on Sage Business Care have already received Report Viewer and Report Manager license(s)* at no charge. This enables you to try the product at zero cost. When stacked up against other products in the market, the purchase of additional licenses and modules provides a very cost-effective solution. Additional fees may be required for multiple licenses.

- Report Viewer – Provides the ability to view existing reports with drill down functionality and some basic filtering options

- Sage 100 Report Manager – Author new reports, Set permissions and security for reports

- Report Designer – Easily create and edit existing reports with a drag and drop graphical interface

- Connector Module – Allows access and the ability to consolidate information from multiple sources and data bases.

14. Used by Thousands of Small Businesses

Sage has chosen to integrate the Intelligence Reporting tool into Sage 100 ERP. Create Sage 100 custom reports with the well established Sage 100 Sage Intelligence. Go from simple financial reporting to intelligent reporting and analysis of your entire Sage 100cloud ERP.

15. Division of Sage

Sage 100 Intelligence Reporting is owned by Sage Software and is part of a whole product offering and is included with current Sage 100cloud licensing. Sage 100 Advanced Reports has access to all the company Modules.

#sage100Intelligencereporting, #sagepowerbi, #sagecrystalreports, #sage100reporting, #sagesoftware, #powerbisage100, #sageintelligencetraining, #sagenearme, #sage100accounting Sage Timeslips Support