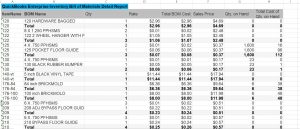

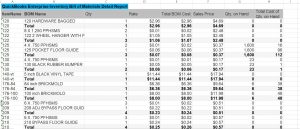

QuickBooks Advanced Report Bill Of Material

QuickBooks Advanced Report – Bill of Material – Do you need a detailed Bill of Material Advanced Report For QuickBooks? We can help you. This report is a sample that shows that you can get what you need for your QuickBooks Inventory Assembly component, bill of material detail or other areas of the system.

Below is a list of Fields that are included on this customized QuickBooks Advanced Bill Of Material Report:

- Inventory assembly (Bill of material ID)

- Bill of material description

- Component ID

- Component description

- Quantity required

- Item Cost

- Bill of material Total Cost

- Bill of materials sales price

- Quantity on hand

- Total Cost of Quantity on hand

This report is sorted by the inventory assembly item id. The Total Bill of Materials Cost is not directly tied to the cost or avg cost values. The total cost of your bill of materials is the sum of the cost values of the components in the BOM. That means the cost of each component multiplied by the number of units required to be used in the bill of material and then each item cost is added to create the total cost of the inventory assembly. For Advanced Reporting for QuickBooks give us a call.

For QuickBooks Training Class view

What is QuickBooks Bill of Material?

The bill of materials is a list of raw materials, sub-assemblies, sub-components, parts, and quantities of each needed to manufacture an finished or end product.

Before you set up your inventory assemblies first you must make sure each item in your bill of materials exists in your inventory list. The other considerations are what type of items will be included in the Bill of Materials (BOM). The options for components include inventory, non-inventory, or service items and burden. These need to be set up as individual items before you create the final bill of material sometimes referred to as the finished item.

These are the steps to add new items in the items list in QuickBooks.

- The first step is to click the Gear icon in the upper-right corner and select Products and Services.

- Click the New button and select Inventory, Non-inventory, or Service.

- Enter the item details. You can reach out for help if you’re unsure of what Income and Expense accounts to use.

- lastly Save and close.

The last step is to add the inventory assembly also known as bill of material ID and to let QuickBooks know it will have a bill of material be sure to select the sub item box. You can then select the individual items, services and other options to define what makes up the bill of materials and the quantity required for each item that will be included in the finished good.

When you build a quantity of the assembly the detailed items (aka the component parts) are removed from the available inventory. The finished item will add to the available quantities the number of items built. The total cost of the items included in the bill are added together and now becomes the total cost of each built item.

What is the difference in a QuickBooks assemblies and QuickBooks bundles?

The term bundle refers to a group of items that you can sell and track in QuickBooks. For example, you can create a bundle called Bird Bath Bundle, which consists of item Bird Bath bottom and Bird Bath Top.

Group items you often sell together into bundles so you can easily add multiple items to transactions.

Bundles can have up to 50 items

There is no additional markup or change in price for bundles. (Bundles aren’t assemblies.) The price of a bundle = The total price of all its items.

You can’t track quantity on hand for bundles so if you want more detail about how many you buy and sell make them stock items

To add a bundle just like any other item. Click Create (+) > Invoice to add the bundle to an invoice.

The form shows whether you choose to show/hide bundle items, either “Your customer won’t see any of the items in this bundle” or “Your customer will see all items in the bundle.”

You can search for bundles by name or SKU like any other item.

Once you add a bundle to a form, you can add, edit, and delete items. You can also discount the bundle.

This is the sample view of the

QuickBooks Advanced Report Bill of Material

QuickBooks Advanced Report Inventory Assemblies and Components Detail

Sage Timeslips Support

Software Installation

#quickbooksbillofmaterial, #quickbooksadvancedreport, #quickbooksadvancedreports, #quickbooksinventory, #quickbooksBOM