Authorized Resource Center

Sage 50 Pervasive SQL Will Not Activate

Sage 50 will not activate – Unable to install or activate Sage 50—U.S. Edition versions 2019 and older – Sage 50 Data Base Engine Updates To Zen Actian SQL may require an upgrade. If you have already purchased the latest version but do not have your serial number, we can help. Perpetual licenses are available until mid-January of 2023. Reach out for support promotional pricing 800-475-1047.

In-product messaging for Sage 50 may be:

- “Your activation key for Sage 50 has expired”

- “Cannot view your company data”

- “Subscription has expired or could not be authenticated”

Error Sage 50 Pervasive SQL Will Not Activate

Sage 50 V. 2023 has been released with important enhancements:

Window 11 Compatibility: We’ve updated the Sage 50 database to Actian Zen v15.1 to keep your business supported and running smoothly.

Whether you plan to install on a new system or update your current one, Sage 50 Accounting—U.S. Edition 2023.0 is up to date. Security is a top priority to keep your data safe and reduce downtime.

Looking only to e-file? You can now add e-filing to your plan so you can access Aatrix within Sage 50 and efile 1099/1096 tax forms without having to navigate outside

the product itself. 1

1099 Forms: Sage is committed to keeping up with regulations to deliver the right solutions at the right time. All customers with an active plan can now access 1099/1096 tax forms via Aatrix to remain compliant with the newest updates.

Sage 50 2023 Notification:

After installing Sage 50 2023 the following versions do not work properly Sage 50 version 2021 and Sage 50 2022.

For Sage 50 version 2022 the open company windows stays open and the navigation displays do not appear at a minimum.

If Sage 50 2023 is installed on the same computer with version 2019 and 2020 – Then when attempting to run 2019 and 2020 the application will not open at all.

Please note if you are attempting to run Sage 50 2019, Sage 50 2020, Sage 50 2021, Sage 50 2022 on the same computer they will need to be freshly installed in the year order. Sage 50 2023 will not run on the same box as other Sage 50 installations and will need to be installed on a new or separate hard drive.

Versions of Sage 50 2019 and lower use the Pervasive PSQL data base engine

Running incompatible versions of Sage 50 on the same computer:

2019 will not install with, 2021, 2022 and 2023.

2023 does not install very well with 2022 as it will cause some problems in 2022, such as, the Navigator not working.

Sage 50 version 2013, Sage 50 2014, Sage 50 2015, Sage 50 2016, Sage 50 2017, Sage 50 2018, 2019 and Sage 50 2020 can be installed on the same PC and should run without issues.

Sage 50 V.2013-2019 – Important details about these Sage 50 Versions and Sage 50 errors you may receive!

Why do we get the message Sage 50 will not activate?

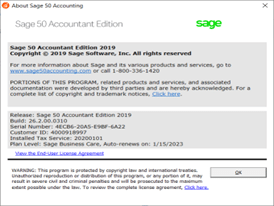

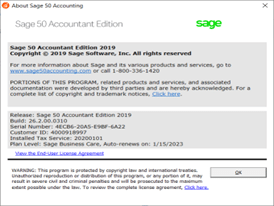

Due to a third-party database component that is no longer supported, you will be unable to reinstall or reactivate Sage 50 US versions 2013 through 2019. For example, should you upgrade hardware and then attempt to reinstall Sage 50 US versions 2013 through 2019, the reinstallation will be unsuccessful. Your Version can be found under Help > About Sage 50 Accounting in this window > > >

To avoid disruption to your business, we strongly recommend you upgrade to the latest supported version of Sage 50 US. For more information, give us a call 800-475-1047:

Summary

Note: You may have received an in-product message (IPM) regarding this. If you are on a currently supported Sage 50 US version, you may safely close and ignore the message, as this issue only affects releases 2019 and earlier. If you are unsure of what version you have, go to help and then about and send us a screen print.

Due to a third-party database component that is no longer supported, Sage 50 US users will be unable to install and activate Sage 50 US versions 2013 through 2019. For example, if you have been using one of these older versions and you up grade your hardware, attempts to reinstall, or reactivate Sage 50 US versions 2013 through 2019 will be unsuccessful.

Attempting to activate will result in the error: “There was a problem activating…”

Other errors that may occur include:

- “Your activation key for Sage 50 has expired”

- “Cannot view your company data”

- “Subscription has expired or could not be authenticated”

Some examples of changes likely to cause reinstallation or reactivation include:

- New laptop/computer for an employee or student

- Upgrading your Operating System (e.g., moving from Windows 7 to Windows 10)

- Updating hardware on a computer (e.g., upgrading memory, HD, network cards, BIOS, etc.)

This situation also applies to colleges and schools participating in our Education Alliance Program. Links to unsupported versions of Sage 50 have been removed from our EAP website to ensure schools are using only versions of the software that are tested and officially supported.

Resolution

To avoid disruption to your business or education program, we strongly recommend you upgrade to the latest supported version of Sage 50, and we can help you download this after purchase.

Sage 50 Resource Center Pricing and Support

Upgrade Peachtree or Sage 50 perpetual to 2023 perpetual or subscription. Give us a call now for promotional offers – 800-475-1047 – expires 01.15.2023

Sage 50 2022 – Important details about Sage 50 Versions and Sage 50 pervasive errors!

Sage 50 Pervasive Error – What is a pervasive error?

This is the notice Sage provided to Sage 50 U.S. Customers,

Cause: Due to a recent update with the Pervasive Database engine this notification

is being sent to Sage 50 customers on Sage 50 version 2013 through Sage 50 version 2019.

Summary of issue being addressed: Pervasive is no longer providing keys to activate older versions of their product. This impacts Sage 50 US 2013 thru 2019. Customers can use the product so long as they do not update their hardware, operating system (to major version), or add new installs. Sage 50 US 2019 and older are unsupported versions and we will not be releasing an update for these products.

Don’t be caught with downtime: Sage 50 pervasive errors may require an upgrade

Keep in mind when processing a Sage 50 upgrade order, installation services and Sage 50 company data conversions could take up to 3 days beginning to end!

What versions of Sage 50 no longer have pervasive activation keys available?

These versions of Sage 50 are affected by the Pervasive database engine change:

- 2013 version of Sage 50

- 2014 version of Sage 50

- 2015 version of Sage 50

- 2016 version of Sage 50

- 2017 version of Sage 50

- 2018 version of Sage 50

- 2019 version of Sage 50

Notification:

Due to a third-party database component that is no longer supported, you will be unable to reinstall or reactivate Sage 50 US versions 2013 through 2019. For example, should you upgrade hardware and then attempt to reinstall Sage 50 US versions 2013 through 2019, the re-installation will be unsuccessful. Your Version can be found under Help > About Sage 50 Accounting in this window > > >

To avoid disruption to your business, we strongly recommend you upgrade to the latest supported version of Sage 50 US. For more information, give us a call 800-475-1047:

How do I fix Sage 50 pervasive errors?

Summary:

Note: You may have received an in-product message (IPM) regarding this. If you are on a currently supported Sage 50 US version, you may safely close and ignore the message, as this issue only affects releases 2019 and earlier. If you are unsure of what version you have, go to help and then about and send us a screen print.

Due to a third-party database component that is no longer supported, Sage 50 US users will be unable to install and activate Sage 50 US versions 2013 through 2019. For example, if you have been using one of these older versions and you up grade your hardware, attempts to reinstall, or reactivate Sage 50 US versions 2013 through 2019 will be unsuccessful.

Attempting to activate will result in the error: “There was a problem activating…”

Other errors that may occur include:

- Your activation key for Sage 50 has expired

- Cannot view your company data

- Subscription has expired or could not be authenticated

Often, we get asked Why is my Sage 50 not activating?

Some examples of changes likely to cause re-installation or reactivation include:

- New laptop/computer for an employee or student

- Upgrading your Operating System (e.g., moving from Windows 7 to Windows 10)

- Updating hardware on a computer (e.g., upgrading memory, HD, network cards, BIOS, etc.)

This situation also applies to colleges and schools participating in our Education Alliance Program. Links to unsupported versions of Sage 50 have been removed from our EAP website to ensure schools are using only versions of the software that are tested and officially supported.

Causes of Sage 50 Actian Zen Pervasive data error

- Actian PSQL is not running on the host computer

- Restart Actian PSQL did not start after restarting the computer

- Actian PSQL did not restart after installing program update

- Hung Actian PSQL is hung up

- Actian is disabled

- Upgraded operating system

- Workstation crash which stopped Actian on server

- Windows 10 performed updates

Resolution for Sage 50 Actian Zen pervasive errors

- Why is my Sage 50 not opening?

- What is pervasive error?

- How do I uninstall and reinstall pervasive?

To avoid disruption to your business or education program, we strongly recommend you upgrade to the latest supported version of Sage 50, and we can help you download this after purchase

To purchase the latest version of Sage 50—U.S. Edition, please contact Sales at 800-475-1047. If you have already purchased the latest version but do not have your serial number, we can help.

Help for Errors like: “Sage 50 cannot be started” when Actian / Pervasive is not running or needs to be restarted errors

Accounting Business Solutions by JCS is offering this Special Promotion valid through June 30th, 2022.

Reach out now for Sage 50 support details 1-800-475-1047

for Sage Support visit and for Sage 50 Training Classes visit

Other topics for Sage 50 services include.