Sage 50 vs Sage 100

Quickly discover the top features found in Sage 50 vs Sage 100 with a side-by-side comparison. Learn if Sage 50 or Sage 100 is a better solution to give you real time control and visibility to support your growing business during a live complimentary demonstration. Once you discover the Pros and Cons of Sage 50 (formerly Sage Peachtree) and Sage 100 (formerly Sage MAS 90 and Sage MAS 200) you’ll know which Sage solution is the best fit and if and why this might be right time to make a move. Accounting Business Solutions by JCS helps businesses understand Sage 50 vs Sage 100 differences every day and optimize them properly.

Learn Key Differences – Advantages And Disadvantages

- Features – Choices for integrations, customization and extended functionality

- Scalability – Do you need room to grow, more users and transaction volume.

- Architecture – Understand the overall design of the data base, API and access.

- Stability – Is it time for go to market speed, performance and responsiveness.

- Visibility – Help to quickly find, report and understand your business KPI.

Authorized Sage Reseller

When you need real time control and visibility work with Sage certified consultants who know Sage 50 and Sage 100, we’re often asked about the differences between them. Our answer to this question varies depending on the unique profile, challenges, and goals of each one of our small business customers.

This is why we engage in a 2-step process with every small business owner who calls us. The first step is a free Discovery call; this allows us to learn all about your business including:

- The accounting software you’re currently using,

- Why and how you’re using it,

- If you’d be better served by learning how to leverage all of its features,

- Or if you’ve “outgrown” it and are ready to upgrade.

Then, we schedule a complimentary Demo to illustrate the findings that surfaced during our Discovery call and highlight our recommendations.

In some cases, after our free Discovery call, we find it’s best for customers to take additional training on Sage 50 to learn more about the Sage 50 features they have access to but aren’t fully applying.

Other times, the results of our Discovery call make it very apparent that it’s time to upgrade to Sage 100, or in its latest true cloud-based software program – Sage Partner Cloud.

For example . . .

Here’s a Start To Compare Sage 50 vs Sage 100

If you’re a small business owner who truly only needs 5 “custom fields” for use per module and you’re OK with limited ability to customize reports and forms, then Sage 50 will accommodate you nicely – as long as you understand how to fully utilize the “custom fields”.

But, if your company needs a virtually unlimited number of user-defined fields, and vast flexibility for customizing reports and forms, then you’re ready to upgrade and unleash the full power of the Crystal Reports used in Sage 100.

That’s just one of the differences between Sage 50 and Sage 100 that we can spotlight for you to make it easier to understand which version is best for you and your business. Join us for a discussion on Sage 50 vs Sage 100.

“Accounting Business Solutions by JCS has been my reseller for over 5 years with a proven track record for consistent knowledgeable and quality support. I highly recommend them.” J. Brown

Which business owner are you?

Are you a Sage 50 user who isn’t getting the most out of it OR are you a growing small business owner who’s ready for a “bigger box”?

Once you understand the main differences between Sage 50 and Sage 100, you’ll be closer to having that answer.

Which of these features and functions are most important to you?

- Multiple Warehouses & Shipping

- Inventory Items

- Vendor-specific costs & and Customer specific pricing

- Quotes, Sales Orders, & Purchase Orders

- Sales Commissions & Price Discounts

Let’s take a closer look… What really are the key differences between Sage 50 vs Sage 100!

We are asked a lot “Is Sage 50 the Same as Sage 100?” The short answer is No!

Data File Size

In Sage 50 there are data limitations to the amount of information can be loaded into your demographic lists as well as the volume of transactions that can be recorded and stored in Sage 50.

Sage 100 does not have either of these limitations.

Do You Need Multiple Warehouses & Real Time Shipping?

Warehouses Logical or Physical

Sage 100 accommodates companies with multiple warehouses, with tracking for each built in, including separate reordering info and product locations. These can be physical or logical ware house locations.

There is also a multi-bin option – by warehouse location – with a fully integrated barcode scanning option.

Sage 50 can only accommodate companies with 1 warehouse with allowance for up to 20 contacts with shipping information and no allowance for alias or alternate part numbers. There is a maximum of 1 bin location per item in Sage 50.

Features For Shipping & Tracking

Sage 100 has unlimited ship-to accounts including sales tax tracking by ship-to address, national accounts, up to 36+ price levels or pricing by customer by item and the ability to print barcodes.

With Sage 100’s shipping module you can print a packing slip, then ship without having to post the invoice and multiple fully integrated add on option to interface with FedX, UPS and USPS (and more) and send tracking information back to the customer invoice.

You can look up prior orders and purchases during quoting, creating sales orders, and invoice entry – and that’s just for starters!

In Sage 50, you use reports or dashboards to look up sales and purchase history. In lieu of true shipping, in Sage 50 once you ship the order it creates an invoice that updates to the open Accounts Receivable. There is a shipping add on option for tracking information back to the customer invoice.

Inventory Items for Sage 50 vs Sage 100

Sage 100 offers inventory items in a range of types – lot, serial, raw materials, or finished items with the ability to report/view traceability.

Additional Sage 100 options include: a physical inventory count process that over time allows for visibility into shrinkage; the ability to scan time and material to travelers /work tickets; a field service option.

Sage 50 inventory items can be raw materials, serialized items, or finished items, but Sage 50 has no physical count processes; these are manually entered using inventory adjustments.

Bill of Materials

In Sage 100, Bill of materials (BOM) can have phantom builds and options and the ability to have nested BOM. Multiple BOM revisions can exist. The Revision retains a complete history of the evolution of the BOM each time it’s modified by storing an accessible copy of the entire bill for each time a revision is entered.

The BOM for any production run can be modified as your needs require. Full manufacturing capabilities are available for repetitive or made-to-order processes using production manager or operations management along with a scheduling option that really streamlines manufacturing processes.

In Sage 50, BOM are just the components needed to make the finished items and are single level only. There is no automated process for managing multi-level BOM.

No manufacturing features are included other than the ability to use a BOM to make a finished item. No scheduling or made-to-order options are available, nor is there the ability to scan time or materials to work tickets. A work ticket only provides the ability to print the BOM that have been assigned to the finished Sage 50 item number. Only the current revision can be produced, and no modifications to the BOM can be made at the time of production.

Compare Vendor-specific Costs & Customer-specific Pricing

Sage 100 has separate Receipt of Good and Receipt of Purchase Invoice entry windows so that item receipts without an invoice do not show up in AP aging, as they do in Sage 50.

Additional Sage 100 inventory items benefits include customer /vendor alias item numbers, the ability to track vendor cost individually by the vendor part number, calculated delivery times and last cost that can be easily seen in the inventory item view.

Quantity pricing can be set for each price level per item including customer-specific pricing.

Sage 50 offers 10 pricing levels and discount by customer only. To get the cost by vendor for the same part a custom report is required. Only 1 quantity price definition can be assigned to an item and only 1 warehouse and 1 bin location by item is allowed.

However, Sage 50 does offer a fully integrated barcode scanning option as an add-on product.

Quotes, Sales Orders, Invoices, & Purchase Orders

In Sage 100 quotes, sales orders and invoices, each detailed line item has a field for anticipated ship date by item and offers a discount by line item.

The purchase orders also have detailed line items with a field for anticipated receipt date. Different dates can be used per line item on both the sales order and purchase order.

Sage 50 only has one transaction date on the header portion of quotes, sales orders, invoices, and purchase orders.

Compare Sales Commissions, Price Discounts, & Sales Tax

In Sage 100, it comes with 1 license for Sage CRM, can track and calculate salesperson commissions by sales, profit, and percentage and can have up to 2 sales reps per invoice and each can have their own commission percent and is fully integrated.

Sage 50 can only report on sales profitability by sales rep and has a single directional integrated CRM.

In Sage 100 customer discounts can be calculated by line item on the sales order, quote or invoice by the customer. This is particularly useful for promotional offers that grant quantity price breaks or price breaks on the overall sales order, quote, or invoice.

Sage 50 discounts are calculated on the inventory item based on the price level. Discounts are also only available against an entire invoice.

In Sage 100 allows for tracking sales tax by ship to location or use tax on purchases. Sage 50 does not.

Sage 100 more closely adheres to GAP standards by not allowing deletion of posted transactions or editing them without an audit trail as can been done in Sage 50.

“Accounting Business Solutions by JCS has been phenomenal to work with! Definitely took the time to get to know my organization and provided outstanding work.” J. Silver

Is Sage 50 still the right fit for your business or is it time to upgrade to Sage 100?

Let’s find out! During your free Discovery Call we’ll learn if Sage 50 is – or can be – the best software for your needs. However, if it’s time for an upgrade to Sage 100, we’ll point out why and how it’s time to make that happen during your complimentary Demo.

What will be your reason for upgrading from Sage 50 to Sage 100?

Many of our customers who have upgraded from Sage 50 to Sage 100 immediately begin using – and benefiting from – the anticipated shipping dates feature for both the sales order and purchase order that relates to individual line items, not just the entire order.

But there are so many more Sage 100 features that can trigger a business owner to make the move to Sage 100. Call now to compare Sage 50 vs Sage 100.

Let us help you discover during a live contrast of top 10 differences between Sage 50 vs Sage 100!

Sage 50 to Sage 100 migration guidance for your small business.

“Ever since our business relationship with Accounting Business Solutions started in 2006,they have provided consistent expert level support and exceptional service that is professional.” – Henry G.

Call 800-475-1047 Today! Let’s get started with a free Discovery Call! We’ll listen and learn about your business, so we understand what drives your revenue stream.

Knowing that whatever drives your revenue steam dictates the best solutions for your business, Accounting Business Solutions by JCS will focus your free Discovery call – and complimentary Demo – on what solution is best for you.!

How to get the cost to upgrade from Sage 50 to Sage 100

When upgrading from Sage 50 to Sage 100 – During an initial discovery call below are a list of frequently asked questions we will need to review in detail before any estimates of service and software costs can be provided. Normally businesses bring over demographic lists and balances only but from time to time we do bring in sales history.

This compiled information provides a baseline of your business model and needs and will be important during a live software demonstration. Learn why you may have outgrown Sage 50 and may need Sage 100 to grow your business.

These Sage 50 questions will help determine if an upgrade to Sage 100 is right for you

- Will this be a start-up company in Sage 100 or a conversion from an existing Sage 50 company?

- Describe how your current Sage 50 system work at a high level?

- How many active customers do you have?

- Do you charge sales tax?

- Would multiple ship to addresses help?

- How many active vendors do you have?

- What is the total number of active inventory items you have?

- Would you use multiple warehouses?

- Does you use Bill of Materials?

- How many active bill of materials does the company use?

- Typically, how many open AP invoices are there at the end of each month?

- Normally, how many open AR invoices are there at the end of each month?

- How many open Purchase Orders do you find at the end of each month?

- What is the number of open Sales Orders you have at the end of each month?

- Would we use existing chart of accounts?

- Do you want sales history from your current Sage 50 company file?

Sage Software Frequently Asked Questions

Question: How do renewal costs from Sage work on Sage 50?

Answer: Sage 50 is named users – meaning you pay for each user who will log into Sage 50 at any time.

Sage 100 is concurrent users – meaning you only pay for the number of users who need to be in at one time.

Question: How does Sage renewals work for Sage 50 when we will be purchasing Sage 100?

Answer: Typically the way the renewals for Sage works for folks going from Sage 50 to Sage 100.

When you purchase Sage 100 you will need to purchase the number of licenses you will need.

You can pay monthly or annually.

Once you cut over on Sage 100 and have decided that you will only need say 1 license for historical look ups

then a request is made to Sage to prorated refund for Sage 50 for the unused amount of time

up to your expiration less the 1 user you will keep.

Tips and Tricks on how to clean up Sage 50 before you convert to Sage 100.

Steps to complete when upgrading from Sage 50 to Sage 100. These are the first steps to help you successfully migrate from Sage 50 to Sage 100.

The first step is to clean up the Sage 50 Lists

How to remove Unwanted Customers

Confirm the customer has no outstanding accounts receivable invoices

Mark the customer inactive

When to remove Unwanted Vendors

Confirm the vendor has no outstanding accounts payable invoices

Mark the vendor inactive

Unwanted Inventory items

Confirm the inventory items has no quantity on hand or value on the inventory valuation report

Mark the inventory item inactive

*this is to only bring over active customer, vendors and inventory items

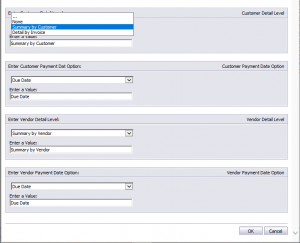

The second step is to clean up Sage 50 Open transactions

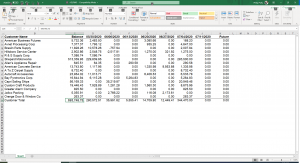

Review the accounts receivable aging report and complete/void/reverse/write-off any transaction you do not expect to be paid. You can also review for credits showing because a receipt is dated prior to an invoice.

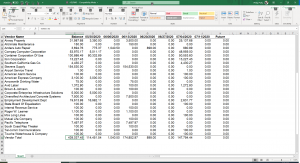

Next, review the accounts payable aging report and complete/void/reverse/write-off any transaction you do not expect to pay. You can also review for credits showing because a check is dated prior to a bill.

Review the Inventory Valuation Report and resolve all negative inventory quantities and/or costs. Confirm quantities and values against the Item Costing Report.

The third step is to Confirm your General Ledger trial balance is in balance

This is critical to start off on when you make the move to Sage 100. Review each of the subsidiaries and clean out other unneeded information when you migrate to Sage 50

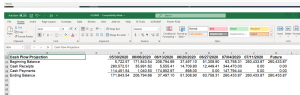

Print the open sales order report with a starting date of 01.01.2010 (or previous)

If you need to specify a date to close the sales order, use the first day of your current period 1

Print the open purchase order report with a starting date of 01.01.2010 (or previous)

If you need to specify a date to close the purchase order, use the first day of your current period 1

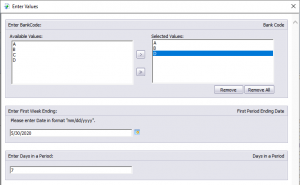

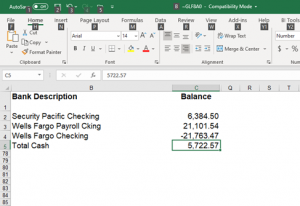

The last step is to review and clean up your Sage 50 Bank Reconciliation

Clean up any outstanding deposits and checks you do not expect to clear the bank.

this is to only bring over transactions that you expect to use in the future in Sage 100

When you are ready to have a live demo when upgrading Sage 50 to Sage 100 reach out 800-475-1047 Today! We’re ready to help you!

Sage 50 Year End Checklist and Sage 100 Year End Close Checklist and Sage Timeslips Support