Sage 100 Accounts Payable Data Conversion

From another System

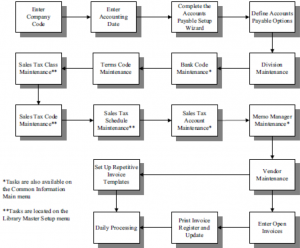

Gather the appropriate information and follow these steps:

- Gather all unpaid invoices as of your last closed accounting period.

- Run a report from your current system or prepare an adding machine tape totaling the invoices. This amount should equal the account balance for the accounts payable account(s) in General Ledger.

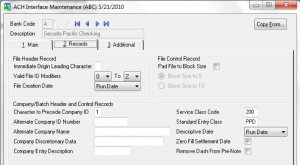

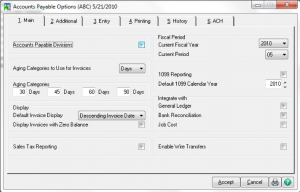

- Set the accounting date to the last day of the last closed accounting period. This is the current period established in Accounts Payable Options.

- Enter 1099 payments in the current calendar year.

- In Invoice Data Entry, enter the outstanding balance amounts for each invoice using the original invoice dates. During the distribution process, post the entire distribution balance to your accounts payable account number in General Ledger.

Note: Do this when you have expensed these invoices in the previous system.

- Print the Invoice Register from the Main menu. The total should equal the balance of the accounts payable account in General Ledger.

- Update the Invoice Register and the Daily Transaction Register.

- Run Full Period End Processing to clear the month-to-date purchases fields and forward to the next period.

- Reset the accounting date to the first day of the current accounting period.

Linking Accounts Payable to Accounts Receivable

- Vendor / Customer Link Maintenance

- AP form AR Clearing Selection

- AP form AR Clearing Entry

- AP form AR Clearing Register

Are you interested in learning about Converting Accounts Payable to Sage 100 from Another System? Accounting Business Solutions by JCS offers Sage 100 training classes, including Converting Accounts Payable to Sage 100 from Another System. Call us today at 800-475-1047 or email us at solutions@jcscomputer.com today to get started.